Great healthcare benefits you can actually afford to use

$0 primary care, so you can build a trusting relationship with your doctor.

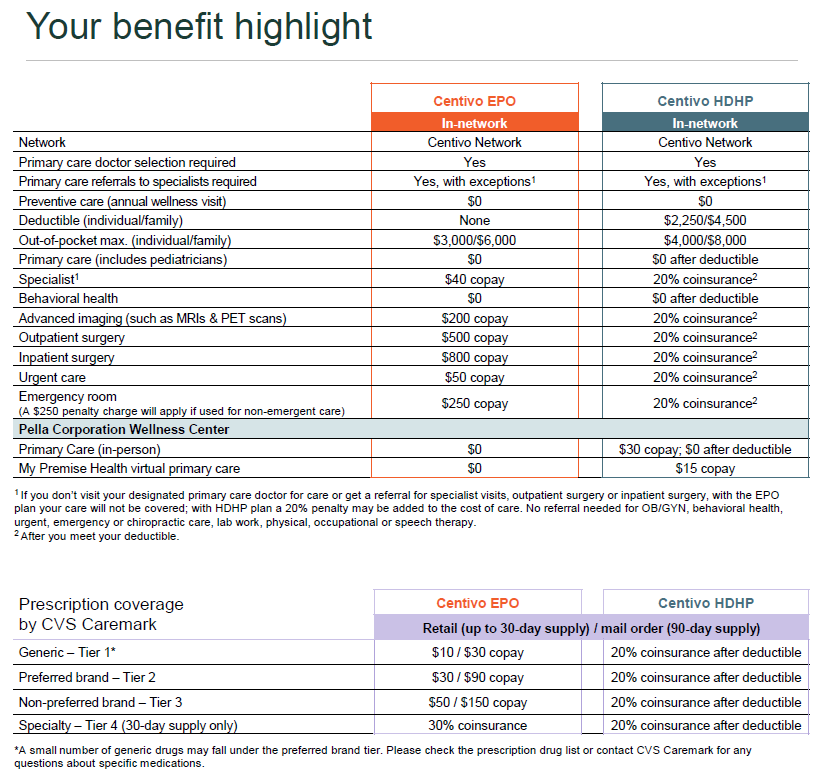

Plan comparisons

You have the choice of two plans that give you access to high-quality healthcare you can actually afford to use.

Plan Name | Centivo EPO | Centivo HDHP | |

Deductible (individual/family) | $0 / $0 | $2,250 / $4,500 | |

$0 annual preventive visit | |||

$0 primary care visits | $0 after deductible | ||

$0 mental health visits | $0 after deductible | ||

Access to Pella Corporation Wellness Center | |||

24/7 virtual care from My Premise Health | |||

Urgent care covered as in-network when outside the network area | |||

Emergency room covered as in-network nationwide | |||

Is a Centivo plan right for you?

If any of these apply to you, you should consider one of Centivo’s plans.

- I want to save $ on my healthcare.

- I see doctors in the Centivo Network and want to continue to see them.

- I’m willing to change doctors.

- I visit urgent care or the emergency room whenever I need care.

- I want to know what I owe – if anything – before I go to the doctor.

View your benefits summary

Need more information to help decide which plan is right for you? We’ve got you covered. View a high-level benefits summary (click image). Or, click to see a plan overview flyer.

how it works

Take these 3 steps to get the most from your plan

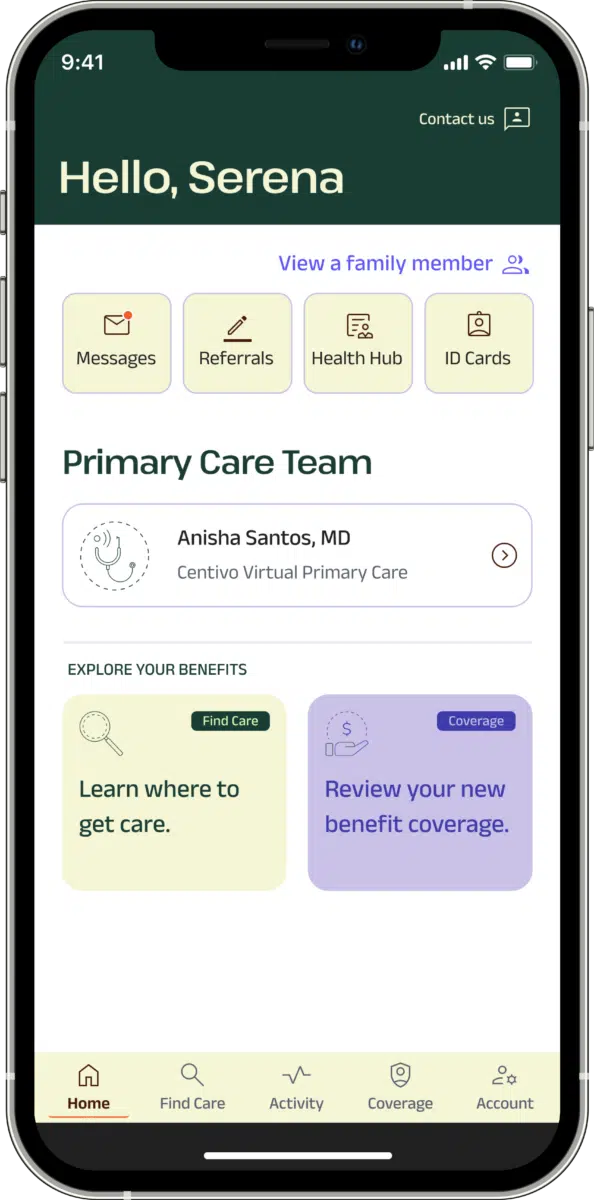

Step 1: Pick a doctor

- Once your plan starts, choose a primary care doctor, a step Centivo calls activation.

- If this is a new doctor, schedule an appointment so they can get to know you and your healthcare needs.

Step 2: See your doctor first for any healthcare needs

- Your doctor can help you stay as healthy as possible.

- When you get sick, your doctor can identify the issue and start treatment.

- If you have ongoing conditions, your doctor can help you manage them and make medication adjustments.

Step 3: Get referrals for specialty care

- Get a referral from your primary care doctor when you need specialist care.

- They’ll send the referral to Centivo for you, and it will be good for one year.

- All you need to do is make sure you see the referral in your Centivo app prior to seeing the specialist.

A health plan you can actually afford to use.

Industry average

Industry average annual out-of-pocket costs for traditional health plans.*

Centivo average

Average annual out-of-pocket costs for a Centivo member.**

Savings with Centivo

Centivo member average annual out-of-pocket savings.

**Based on Centivo 2022 book of business data.

Understanding key insurance terms

The amount you pay out-of-pocket before the plan pays towards your healthcare costs. There is no deductible with Centivo EPO, but there is a deductible with Centivo HDHP.

A fixed dollar amount you pay for a healthcare service or visit. Centivo EPO has set copays for care.

The percentage of costs you’re responsible for after you meet your deductible. Centivo HDHP coinsurance is 20%, so you’ll owe 20% of the cost after you reach your deductible (except for $0 primary care visits once you’ve hit your deductible).

The most you’ll pay for any covered healthcare expenses during the plan year.